The above challenges should be taken into account before investing in any company that claims to be on the verge of fundamentally changing the way large corporations or governments work.

When it comes to the general public however, we are a more bullish on the potential rate of mass adoption. Our reasons for this are threefold:

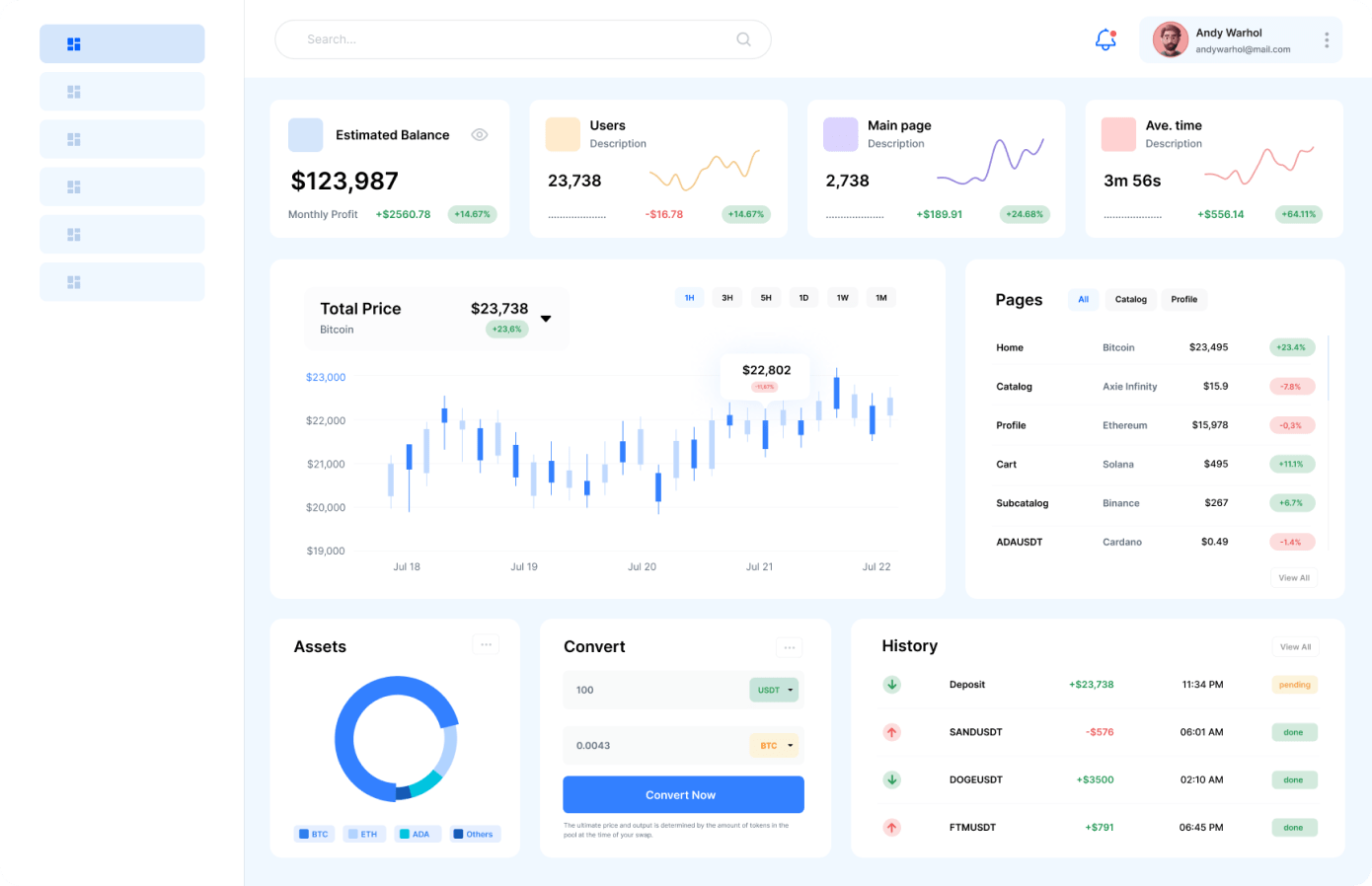

- Cryptocurrency and dApps can be seamlessly integrated with existing technology (i.e. the internet).

- dApps have the potential to offer the same services as normal applications at a fraction of the cost. Hence there will be a significant driver for user adoption.

- The number of dApps are likely to increase exponentially over the next few years as the barrier to entry for developers is reduced.

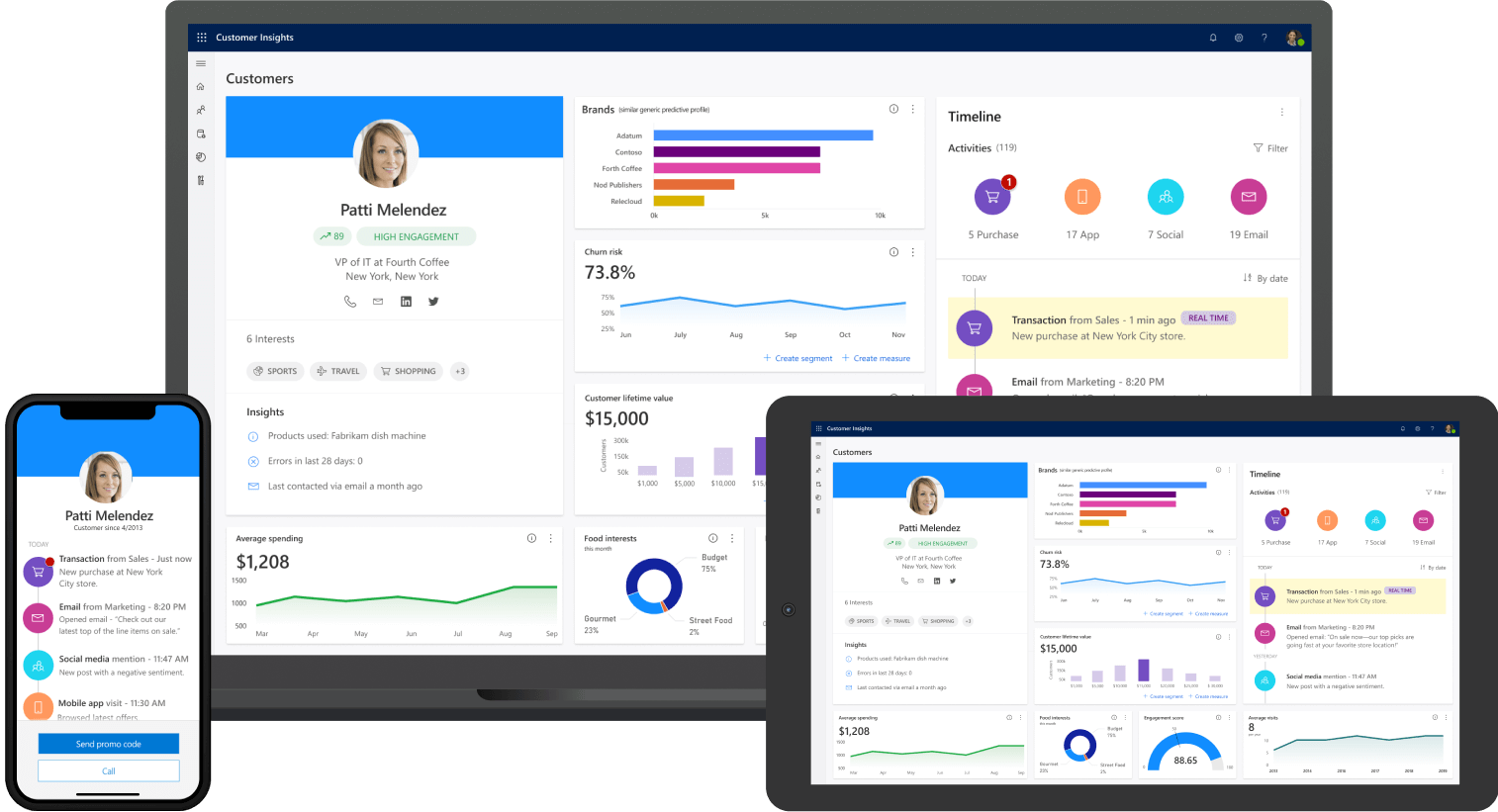

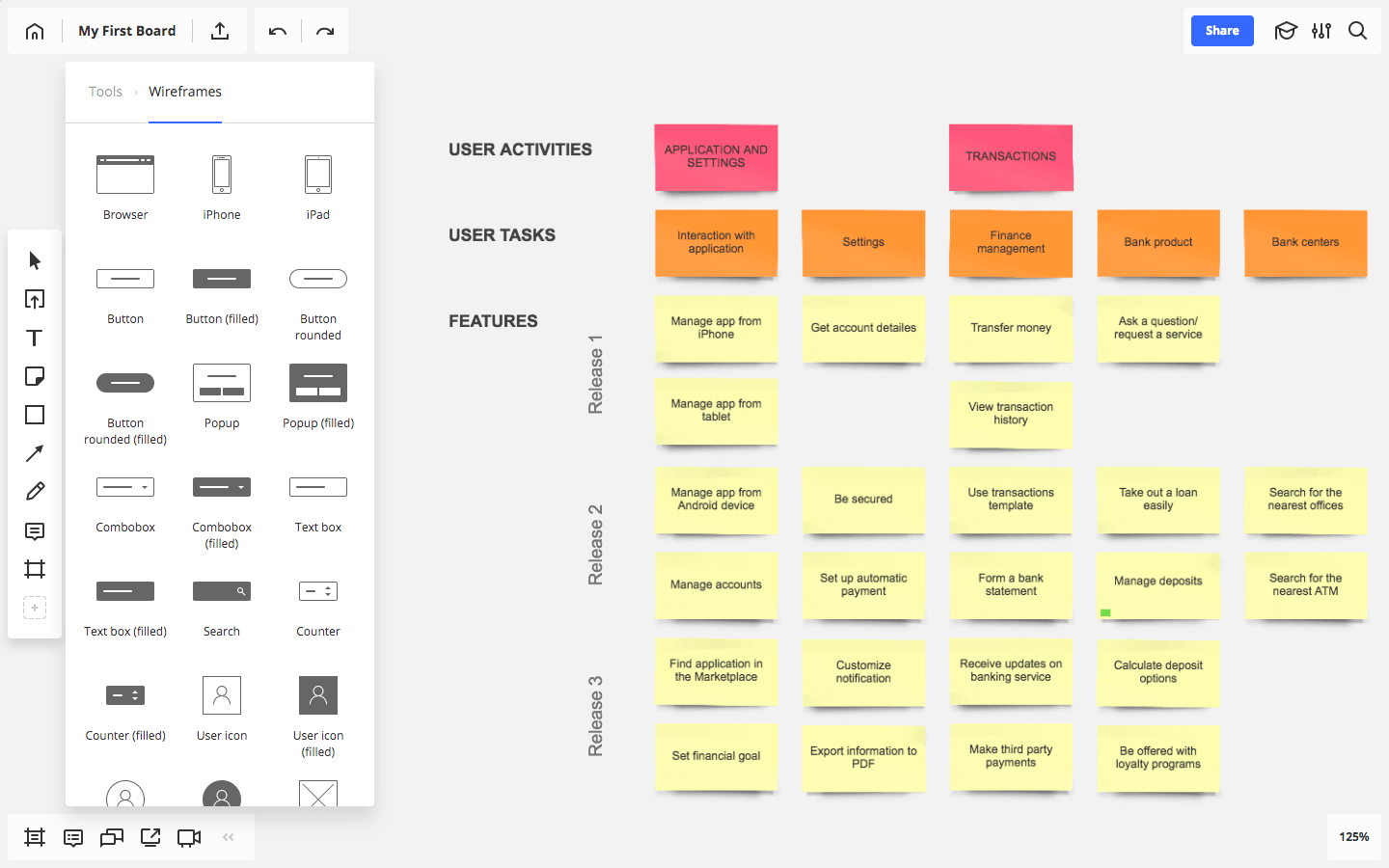

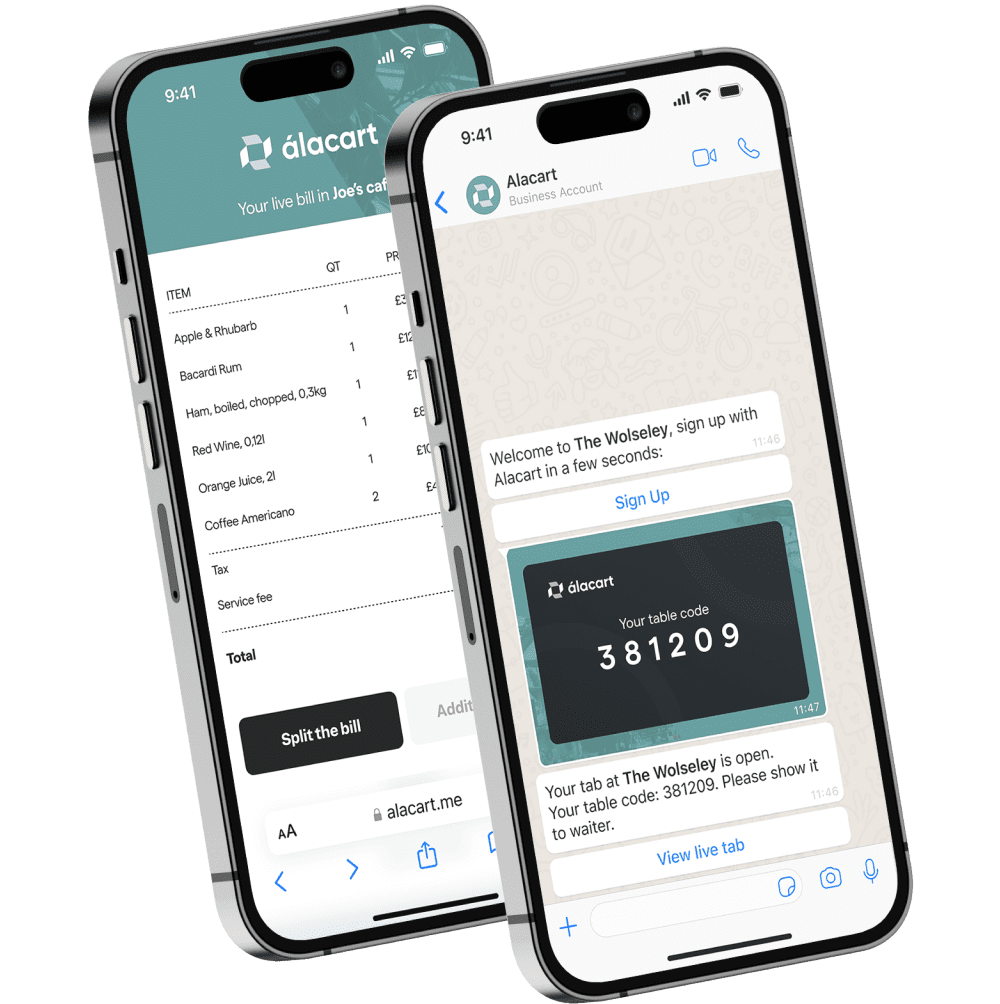

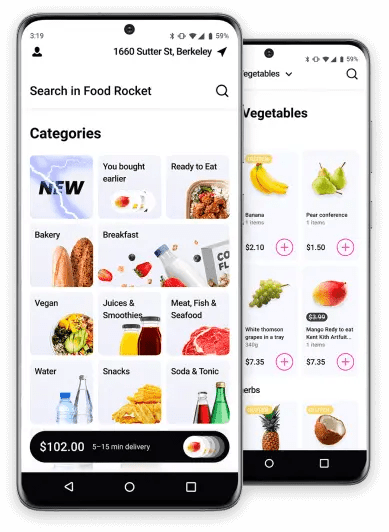

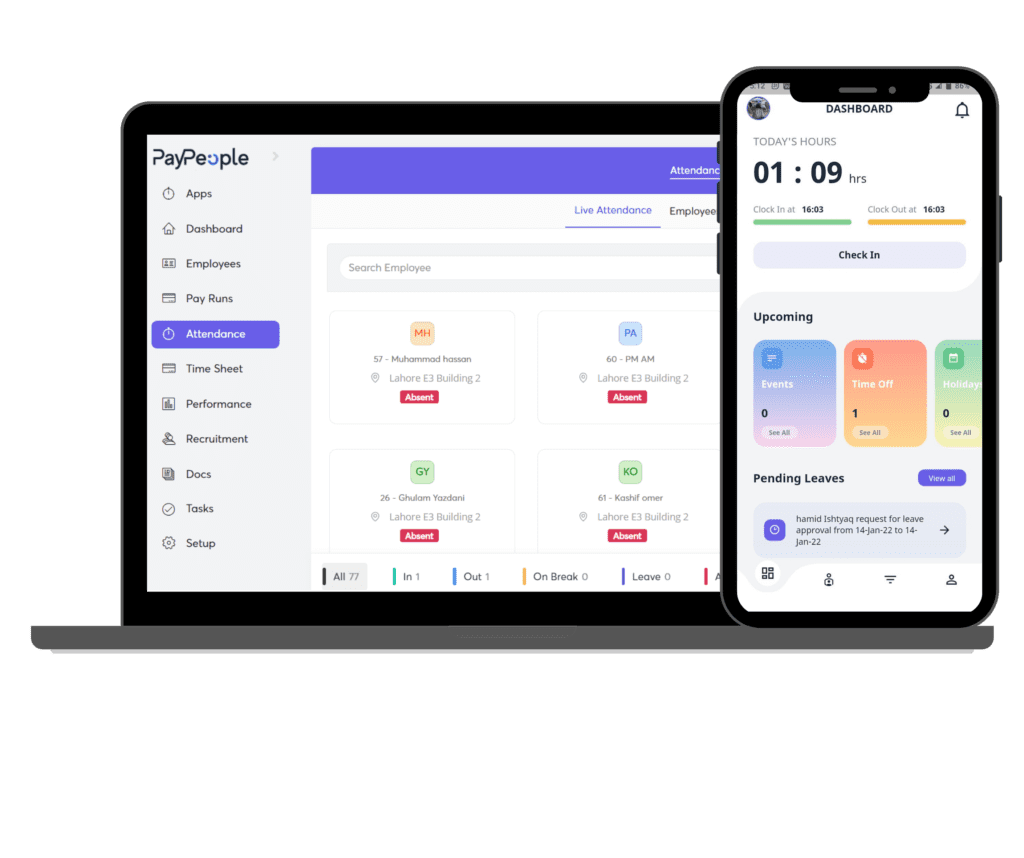

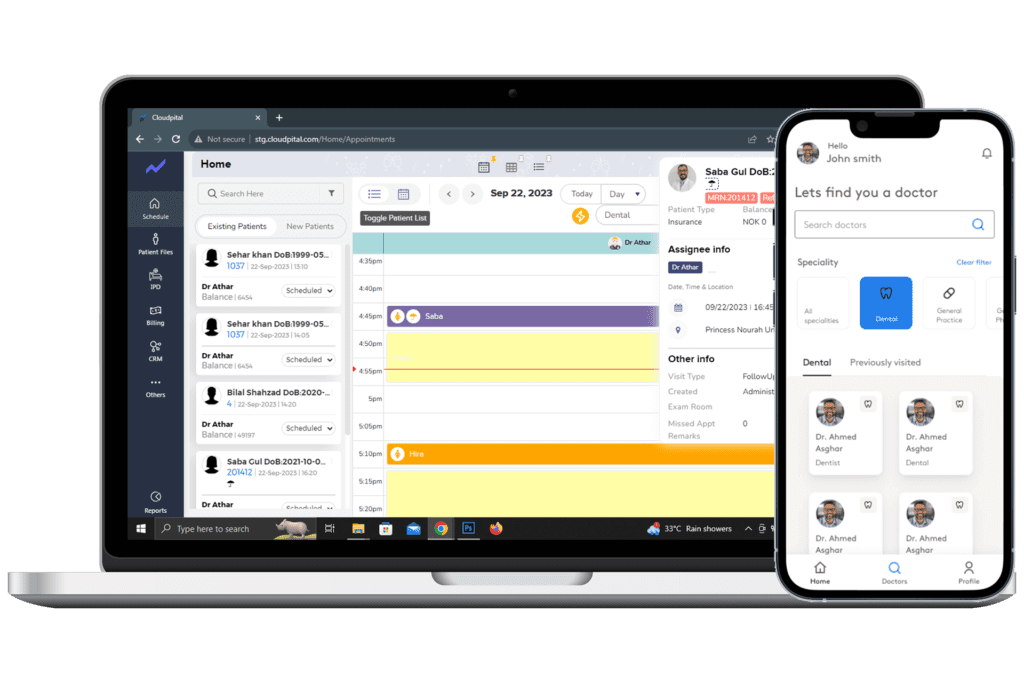

Given these three factors, we think it’s likely that one or more dApps will capture significant market share (or invent a brand new market) at some point over the next two to three years. There is one important caveat to this assumption. Two major user barriers to entry will need to be removed before mass adoption of any dApp can take place; UI that enables seamless interaction with blockchains via your mobile phone or internet browser; removing the need to go through exchanges to purchase cryptocurrency and tokens.

Blockchain Impact

While plenty of people have doubts about blockchain’s rate of adoption or one or more of its specific use cases, it is rare to find articles with detailed arguments against the overall potential of the technology. The most coherent and detailed article we came across in our research was written by Zack Korman, co-founder at Awesome Power Inc. In his article, Korman makes the following points:

- Most dApps “solve” a problem that can be solved more efficiently without blockchain technology

- Decentralization is a disadvantage for consumers in many applications

- Intermediaries serve a useful function

Lets look at each of the above points in more detail

Most dApps “solve” a problem that can be solved more efficiently without blockchain technology

There is some truth to this statement. Gideon Greenspan, the CEO of MultiChain, a ‘Build-your-own-blockchain’ service for companies, wrote an article a few years ago describing a set of conditions that need to be true for a project to benefit from the use of blockchain technology. Gideon’s recommendation boils down to the following: For blockchain technology to be a useful solution, you need to have a problem that requires a database with multiple, non-trusting writers for which there are clear benefits/efficiencies in removing intermediaries. Finally, if the information in the blockchain refers to non-digital assets, there needs to be a trusted, central authority to guarantee the owners access to those assets (if a blockchain says I own a piece of property, it doesn’t matter unless the government agrees that the information in the blockchain is correct and therefore backs my ownership of said property).

While we agree with the statements in the above paragraph, we think there are countless use cases that actually do fulfill all of the above conditions. Some of which have the potential to impact the world in a drastic way. The challenge for blockchain investors is separating those that do from those that don’t.

Decentralization is a disadvantage for consumers in many applications

The argument here is that the immutable nature of blockchains make them poor instruments for keeping track of information where users would benefit from some level of centralized control. If someone posts an embarrassing or defamatory picture of you on Facebook, their centralized control give them the ability to take it down on your request. On a decentralized social network, this would be much more difficult if not impossible.

Hence each application of blockchain technology needs to consider both the cons and pros of decentralization. If the cons outweigh the pros, a permissioned/private blockchain may be a better solution if it still offers significant efficiencies compared to traditional ways of managing information.

Intermediaries serve a useful function

Intermediaries do serve a useful function, and that function is to establish trust between two otherwise untrusting parties. The beauty of blockchain is that it allows untrusting parties to interact with each other without requiring trust to be established. Out of the three arguments against blockchain potential, this is the weakest one in our opinion. Having said that, it is important to consider the actual cost of intermediaries within a specific use case when evaluating the potential of a blockchain application. If this cost is near-zero, it will be more difficult to convince people and organizations to make the switch to a blockchain based application.

In conclusion, nothing we read during our research convinced us that the long-term potential of blockchain technology is overhyped. It did however shed light on some of the potential pitfalls of blockchain applications. This will no doubt enable us to more accurately assess potential investment opportunities in the future.